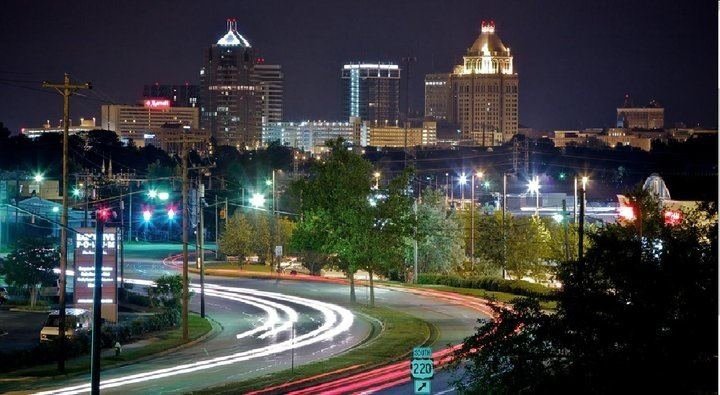

Work with Arrington Investment Properties, LLC to enjoy the full advantages of quick closings on great deals by paying cash for your investment property in Greensboro , you can get started faster than you may think.

While there are both advantages and disadvantages, making a cash offer means that your offer to purchase an investment property in Greensboro is purely an all-cash offer and you won’t need to obtain a mortgage. This may make a similar offer to yours less appealing, as the deal will close more quickly without all of the red tape underwriting a mortgage involves. In addition, while your offer is a certainty, other buyers who require financing can make no guarantee they’ll be approved at the end of the day.

Let’s Make a Deal

If you want to ensure that your cash deal is the most appealing, you’ll need back-up for your offer in black and white, the more organized the better. You’ll need to be positive you’ve got all of your costs covered and carefully craft your cash offer, making the best impression possible for the seller’s needs.

Gather Your Funds

When it comes time to make the deal, you’ll need to show the seller that you can put your money where your mouth is. To take full advantage of paying cash for your Greensboro investment property, it’s best to have all of the funds allocated towards your investment together in one account. This will help to keep you on top of your available closing funds. Remember, you’ll need to have ready cash when you present your offer.

Make a Budget for Buying

Closing is not the time to find out about a surprise expense that you aren’t prepared to meet. Before signing on the dotted line, be certain you’ll have the cash to cover the additional expenses involved in closing by making a budget. These costs can include Greensboro property taxes, homeowner association fees and the like. Be sure you’re aware of all possible costs or you could lose your deal.

Draft Your Offer

You’ll want to have the proper form filled out for the cash offer and have your financial statement in hand for the seller to review. Along with the offer, you’ll want to include a modest deposit, to show the strength of your commitment to the deal as well. Remember, when you’re offering cash your offer has the advantage of certitude with the seller, enabling you to make a lower offer than a buyer who needs time for financing and approval.

Presentation is Everything

If the home is new or was recently updated, you can sweeten the offer and speed things up even more by skipping an inspection requirement. Time is money, you’ve likely heard this saying all through your life. Due to the advantage of having your cash in hand, you can set any closing date that will satisfy your sellers immediate needs.So, instead of the typical 30 days or more with a conventional mortgage closing, you can write your offer to provide them with cash in hand after only 10 days.

Advantages

It can’t be overstated that sellers find quick and sure cash offers more appealing. This means that you have the advantages on your side when it comes time for the seller to consider all of their offers.

Faster Transaction

Naturally, without all of the parties involved in the traditional home financing process, your deal will move much more quickly through the system. Once all of the requirements of the contract have been met, you can pay cash for the Greensboro investment property in as fast as 10 days or even less!

No Potential Cogs in the Wheel

With mortgages come steps that take much more time and cost buyers additional money. Among these steps are inspections, appraisals, and the mortgage approval process which can lead to even more delays or even worse, be denied. As a cash buyer, you can make your offer even more appealing to the buyer and skip some or even all of these steps.

Disadvantages

While there are a great deal of advantages gained when you pay cash for a Greensboro investment property, as with everything, there are a few negatives.

Your Eggs in One Basket

Because you’re placing your cash into the investment property, it won’t be available for other opportunities that may come along.

No Deductions

Buyers who leverage their funds through a mortgage are able to take deductions on the mortgage interest for their investment. As a cash investor, you won’t be able to take advantage of these deductions.

If you want to avoid buyer’s remorse and feel secure that you’re making the best buy with your cash and you’re ready to seize the day by making an investment in Greensboro property, take the first step by working with Arrington Investment Properties, LLC! Send us a message or call (336) 707-5223 today.